Profit From China’s Drop in Shipping Container Production

Just as container shipping lines were beginning to emerge from the worst slump in almost a decade, China’s commitment to save the planet has delivered a price shock to the global shipping industry, sending container prices soaring as much as 69 percent from last 2016’s lows. Singamas, a leading manufacturer of containers, has halted operations at some of its six plants in China to revamp production lines. Its biggest competitor, China International Marine Containers, is also adjusting its production to adopt the environmental initiative.

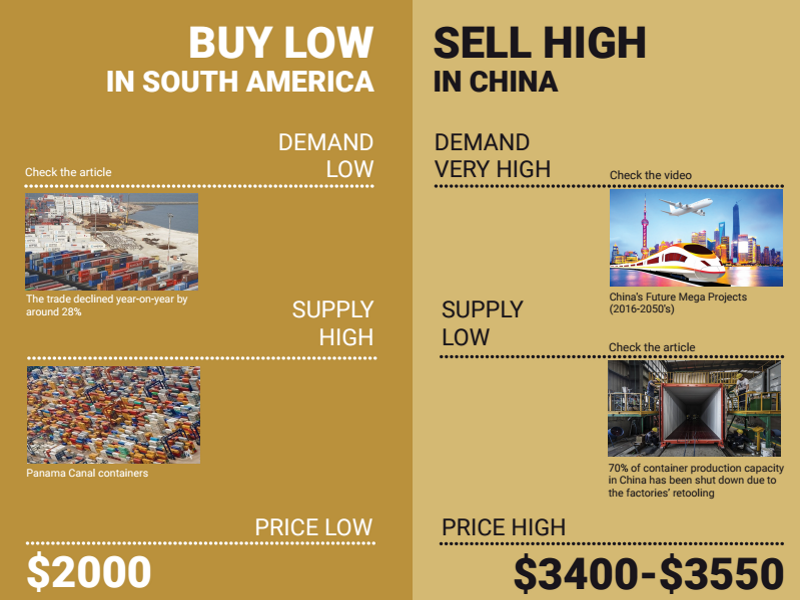

As part of their pledge to cut emissions by 70 percent before China starts levying a green tax in January 2018, container manufacturers are coating containers with water-borne paints that release less toxic fumes than oil-based varieties. The fumes from oil-based paints used on ships and containers have been identified as a possible contributor to greenhouse gases and health threat. The challenge for the industry is that, while manufacturers retool their factories to allow for the use of the new paints, container production capacity in China has been reduced by approximately 70 percent.

The drop in production at both Singamas and China International Marine Containers, has created a spike in the demand for shipping containers, particularly from Chinese container lines and leasing companies. This has caused shipping companies to frantically search for unused, available containers at ports worldwide. One such region where containers are waiting for redeployment is Brazil in South America.

Just a few years ago, Brazil was heralded as one of the fastest growing BRIC [Brazil, Russia, India, China] economies. The emerging market was selling vast quantities of raw materials and commodities to China, and establishing strong economic growth. Moreover there was bustling trade between Latin America and other emerging areas, such as Africa and the Middle East; where there was a strong demand for many of the perishable exports from Brazil.

At the beginning of 2016, container spot freight rates between Shanghai (China) and the Port of Santos (Brazil) languished at a sub-market rate of US$600 (or less) per FEU. This forced carriers to reassess their participation in South American trade. The challenges were attributed to falling demand, thanks to the deepening Brazilian recession. In fact, according to Drewry, demand for Brazilian exports has declined by approximately 28 percent year-on-year. This has left a surplus of empty shipping containers at South American ports.

To capitalize on this lucrative opportunity, transport, logistic, and leasing companies would do well to invest in these containers and deploy them to China, where demand and value are high. Contact us to learn more about how you can profit from China’s 70 percent drop in container production, and South America’s surplus shipping containers.